RBI issued the Compliance Circular on April 11, 2022. It’s for certain types of NBFCs -𝐌𝐢𝐝𝐝𝐥𝐞 𝐋𝐚𝐲𝐞𝐫 (𝐍𝐁𝐅𝐂-𝐌𝐋) 𝐚𝐧𝐝 𝐔𝐩𝐩𝐞𝐫 𝐋𝐚𝐲𝐞𝐫 (𝐍𝐁𝐅𝐂-𝐔𝐋). These NBFCs need to have a framework for the Compliance Function and appoint a Chief Compliance Officer (CCO) by October 1, 2023 (for NBFC-ML) and April 1, 2023 (for NBFC-UL).

This circular talks about something called ‘Compliance Risk.’ This idea has been important for banks for a long time. Now, it’s also important for some NBFCs. The circular defines Compliance risk like this:

‘𝘁𝗵𝗲 𝗿𝗶𝘀𝗸 𝗼𝗳 𝗹𝗲𝗴𝗮𝗹 𝗼𝗿 𝗿𝗲𝗴𝘂𝗹𝗮𝘁𝗼𝗿𝘆 𝘀𝗮𝗻𝗰𝘁𝗶𝗼𝗻𝘀, 𝗺𝗮𝘁𝗲𝗿𝗶𝗮𝗹 𝗳𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗹𝗼𝘀𝘀 𝗼𝗿 𝗹𝗼𝘀𝘀 𝗼𝗳 𝗿𝗲𝗽𝘂𝘁𝗮𝘁𝗶𝗼𝗻 𝗮𝗻 𝗡𝗕𝗙𝗖 𝗺𝗮𝘆 𝘀𝘂𝗳𝗳𝗲𝗿, 𝗮𝘀 𝗮 𝗿𝗲𝘀𝘂𝗹𝘁 𝗼𝗳 𝗶𝘁𝘀 𝗳𝗮𝗶𝗹𝘂𝗿𝗲 𝘁𝗼 𝗰𝗼𝗺𝗽𝗹𝘆 𝘄𝗶𝘁𝗵 𝗹𝗮𝘄𝘀, 𝗿𝗲𝗴𝘂𝗹𝗮𝘁𝗶𝗼𝗻𝘀, 𝗿𝘂𝗹𝗲𝘀 𝗮𝗻𝗱 𝗰𝗼𝗱𝗲𝘀 𝗼𝗳 𝗰𝗼𝗻𝗱𝘂𝗰𝘁, 𝗲𝘁𝗰., 𝗮𝗽𝗽𝗹𝗶𝗰𝗮𝗯𝗹𝗲 𝘁𝗼 𝗶𝘁𝘀 𝗮𝗰𝘁𝗶𝘃𝗶𝘁𝗶𝗲𝘀.’

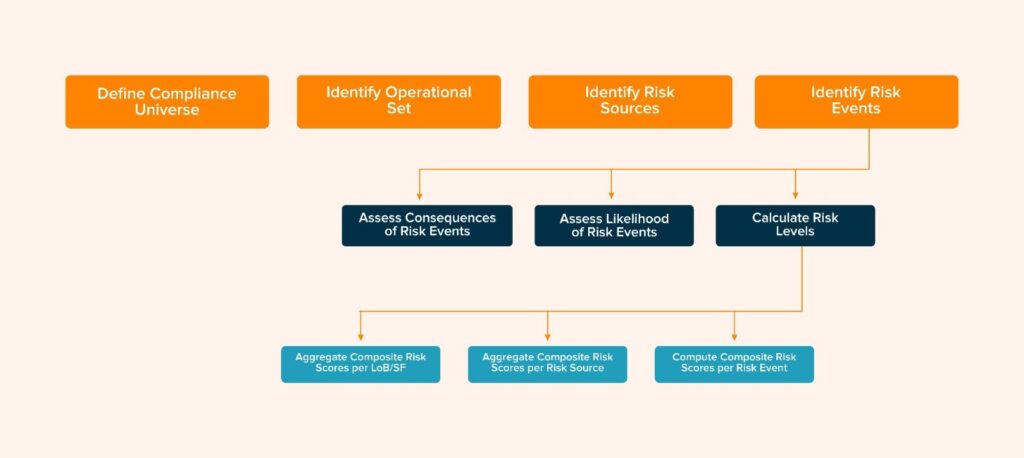

So, 𝗖𝗼𝗺𝗽𝗹𝗶𝗮𝗻𝗰𝗲 𝗥𝗶𝘀𝗸 isn’t just about fines; it’s about all the bad stuff that can happen if a company doesn’t follow the rules. This can be really serious, like having to stop doing business or damaging the company’s reputation. To prepare for and prevent these risks, the RBI requires a good system for assessing these risks, and senior management should check them every year.

According to the 𝗥𝗕𝗜 𝗿𝘂𝗹𝗲𝘀, the Compliance Department must make sure the NBFC follows all the laws and rules. This includes how they treat customers, handle conflicts of interest, and provide the right services.

𝗔𝗻 𝗡𝗕𝗙𝗖 needs to have the right setup to make sure everything goes well. The Chief Compliance Officer (CCO) and the Compliance Department are very important in this setup. They make sure we pay attention to big risks and have good controls in place to manage them.