It is a bitter fact that most organizations experience a difficult time managing fixed assets since they need to know their exact locations and what conditions they are in. Customers who fail to conduct fixed asset verification may face several potential consequences and losses. Fixed asset verification is crucial for businesses to ensure accuracy and reliability in their financial reporting and management.

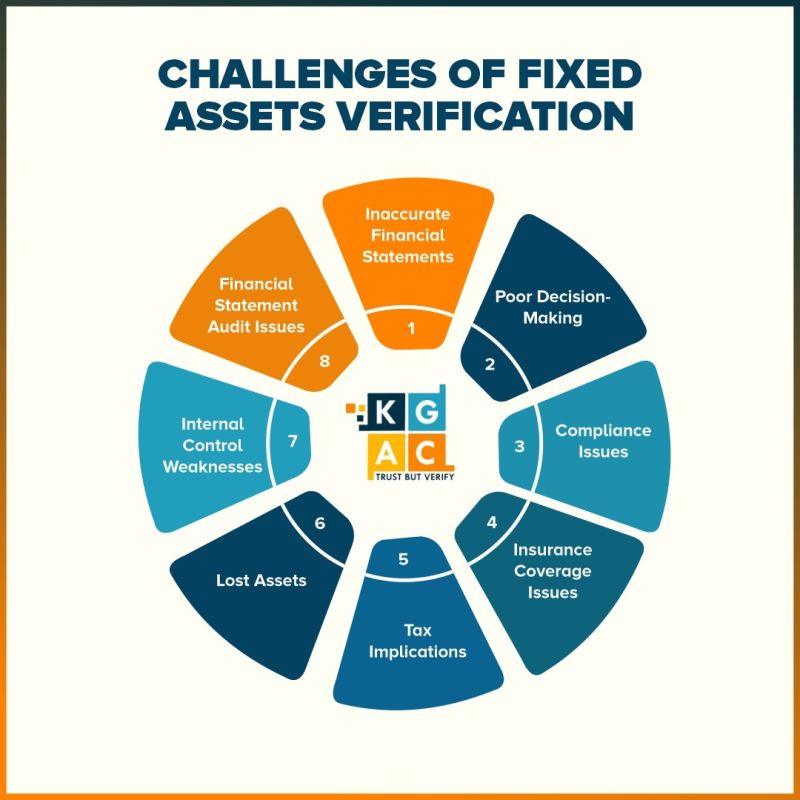

Here are some potential losses and consequences:

𝗜𝗻𝗮𝗰𝗰𝘂𝗿𝗮𝘁𝗲 𝗙𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗦𝘁𝗮𝘁𝗲𝗺𝗲𝗻𝘁𝘀:

Without proper fixed asset verification, the financial statements may not reflect the actual value of the company’s assets. This can lead to inaccuracies in financial reporting, affecting the business’s overall financial health.

𝗣𝗼𝗼𝗿 𝗗𝗲𝗰𝗶𝘀𝗶𝗼𝗻-𝗠𝗮𝗸𝗶𝗻𝗴:

Inaccurate asset information can result in poor decision-making. Management relies on accurate data to make informed decisions about investments, expansions, and other strategic moves. If the asset information is correct, decisions may be correctly guided.

𝗖𝗼𝗺𝗽𝗹𝗶𝗮𝗻𝗰𝗲 𝗜𝘀𝘀𝘂𝗲𝘀:

Some industries and regulatory bodies require businesses to maintain accurate records of their fixed assets. Failure to comply with these regulations can result in fines, legal issues, and damage to the company’s reputation.

𝗜𝗻𝘀𝘂𝗿𝗮𝗻𝗰𝗲 𝗖𝗼𝘃𝗲𝗿𝗮𝗴𝗲 𝗜𝘀𝘀𝘂𝗲𝘀:

Incorrect asset values can affect insurance coverage. The company may be underinsured if assets are undervalued, leading to financial losses in theft, damage, or other unforeseen events.

𝗧𝗮𝘅 𝗜𝗺𝗽𝗹𝗶𝗰𝗮𝘁𝗶𝗼𝗻𝘀:

Fixed assets contribute to the calculation of depreciation, which affects tax liabilities. Only accurate asset information may result in correct depreciation calculations, leading to errors in tax reporting and potential penalties.

𝗟𝗼𝘀𝘁 𝗔𝘀𝘀𝗲𝘁𝘀:

The company may be aware of lost, stolen, or misplaced assets with proper verification. This can lead to financial losses and operational disruptions.

𝗜𝗻𝘁𝗲𝗿𝗻𝗮𝗹 𝗖𝗼𝗻𝘁𝗿𝗼𝗹 𝗪𝗲𝗮𝗸𝗻𝗲𝘀𝘀𝗲𝘀:

Fixed asset verification is a part of internal control procedures. Neglecting this process can weaken internal controls, making the company more susceptible to fraud or mismanagement.

𝗙𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗦𝘁𝗮𝘁𝗲𝗺𝗲𝗻𝘁 𝗔𝘂𝗱𝗶𝘁 𝗜𝘀𝘀𝘂𝗲𝘀:

During financial statement audits, auditors may identify discrepancies or lack of verification in fixed asset records. This can lead to extended audit processes, increased audit costs, and potential negative impacts on the company’s relationships with investors and stakeholders.

Fixed asset verification is a critical aspect of financial management and reporting. Neglecting this process can result in financial, operational, and compliance-related losses for a business. It is essential for organizations to regularly conduct fixed asset verifications to maintain the accuracy and reliability of their financial information.