𝗧𝗵𝗲 𝗥𝗕𝗜 𝗵𝗮𝘀 𝗯𝗲𝗲𝗻 𝗰𝗿𝘂𝗰𝗶𝗮𝗹 𝗶𝗻 𝗿𝗲𝗴𝘂𝗹𝗮𝘁𝗶𝗻𝗴 𝘁𝗵𝗲 𝗡𝗕𝗙𝗖 𝘀𝗲𝗰𝘁𝗼𝗿 over the years. With the sector’s evolution and changing dynamics, the regulator has been proactive in amending regulations.

Previously, NBFCs were classified into two categories:

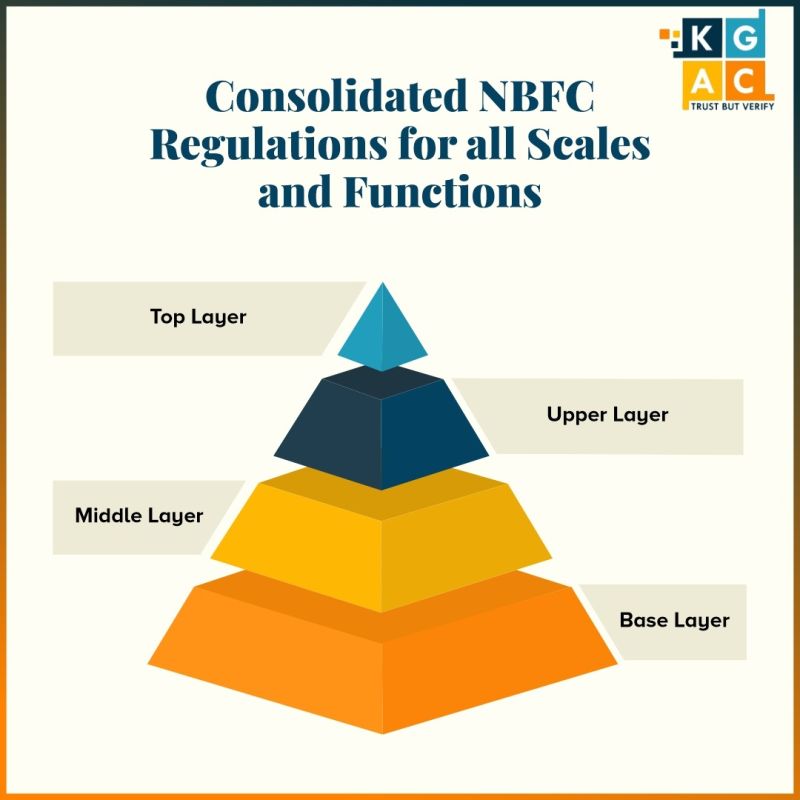

𝗦𝘆𝘀𝘁𝗲𝗺𝗶𝗰𝗮𝗹𝗹𝘆 𝗜𝗺𝗽𝗼𝗿𝘁𝗮𝗻𝘁 𝗮𝗻𝗱 𝗡𝗼𝗻-𝗦𝘆𝘀𝘁𝗲𝗺𝗶𝗰𝗮𝗹𝗹𝘆 𝗜𝗺𝗽𝗼𝗿𝘁𝗮𝗻𝘁. However, starting in October 2022, the RBI introduced a new classification system based on layers: Base, Middle, Upper, and Top.

In the SBR Notification issued on October 22, 2021, the RBI provided clarification that the previous nomenclature “𝗡𝗕𝗙𝗖-𝗡𝗗” (𝗡𝗼𝗻-𝗗𝗲𝗽𝗼𝘀𝗶𝘁 𝗧𝗮𝗸𝗶𝗻𝗴 𝗡𝗼𝗻-𝗕𝗮𝗻𝗸𝗶𝗻𝗴 𝗙𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗖𝗼𝗺𝗽𝗮𝗻𝘆) 𝘄𝗼𝘂𝗹𝗱 𝗯𝗲 𝗿𝗲𝗽𝗹𝗮𝗰𝗲𝗱 𝘄𝗶𝘁𝗵 “𝗡𝗕𝗙𝗖-𝗕𝗟.” 𝗔𝗱𝗱𝗶𝘁𝗶𝗼𝗻𝗮𝗹𝗹𝘆, 𝘁𝗵𝗲 𝘁𝗲𝗿𝗺𝘀 “𝗡𝗕𝗙𝗖-𝗗” (𝗗𝗲𝗽𝗼𝘀𝗶𝘁-𝗧𝗮𝗸𝗶𝗻𝗴 𝗡𝗕𝗙𝗖) 𝗮𝗻𝗱 “𝗡𝗕𝗙𝗖-𝗡𝗗-𝗦𝗜” (𝗦𝘆𝘀𝘁𝗲𝗺𝗶𝗰𝗮𝗹𝗹𝘆 𝗜𝗺𝗽𝗼𝗿𝘁𝗮𝗻𝘁 𝗡𝗼𝗻-𝗗𝗲𝗽𝗼𝘀𝗶𝘁 𝗧𝗮𝗸𝗶𝗻𝗴 𝗡𝗕𝗙𝗖) 𝘄𝗼𝘂𝗹𝗱 𝗯𝗲 𝘀𝘂𝗯𝘀𝘁𝗶𝘁𝘂𝘁𝗲𝗱 𝘄𝗶𝘁𝗵 “𝗡𝗕𝗙𝗖-𝗠𝗟” 𝗼𝗿 “𝗡𝗕𝗙𝗖-𝗨𝗟.”

Nevertheless, after an initial examination of the SBR Master Directions, it becomes evident that specific directives traditionally meant for NBFC-SI and logically relevant for NBFC-ML are explicitly maintained for NBFCs with assets exceeding ₹ 500 crores. Here is a compilation of such directives:

✅ All NBFCs need to be registered with the RBI.

✅ NBFCs must follow KYC and AML guidelines to prevent money laundering and terrorist financing.

✅ All NBFCs are expected to adhere to a Fair Practices Code, which outlines ethical business practices, transparency, and fairness in their dealings with customers.

✅ Interest rates charged by NBFCs are subject to regulation by the RBI.

✅ NBFCs need to follow the guidelines for asset classification and provisioning.

✅ Regulations govern the functioning of Securitization Companies (SCs) and Reconstruction Companies (ARCs), which are specialized NBFCs involved in the acquisition and resolution of stressed assets.

✅ NBFCs engaged in microfinance activities have specific regulations.

✅ Housing Finance Companies (HFCs) have specific regulations governing their activities, including the requirement to invest in housing and real estate-related assets.

✅ Promoters of new entities applying for an NBFC license are required to set up a NOFHC structure.

✅ NBFCs, particularly Systemically Important NBFCs (SI-NBFCs), are subject to more stringent regulations regarding liquidity management and risk mitigation.

✅ Corporate governance guidelines for NBFCs emphasize the role of the board, internal controls, and compliance mechanisms.

✅ All NBFCs are subject to periodic regulatory reporting and supervision by the RBI. The frequency and depth of supervision may vary based on the category and size of the NBFC.

It’s essential to note that regulations and guidelines are subject to change and updates by the RBI.