We may have encountered numerous cases where individuals engage in fraud and forgery to deceive banks and obtain financial benefits. The core principles of lending primarily center on ensuring safety, maximizing profitability, and maintaining liquidity in loans.

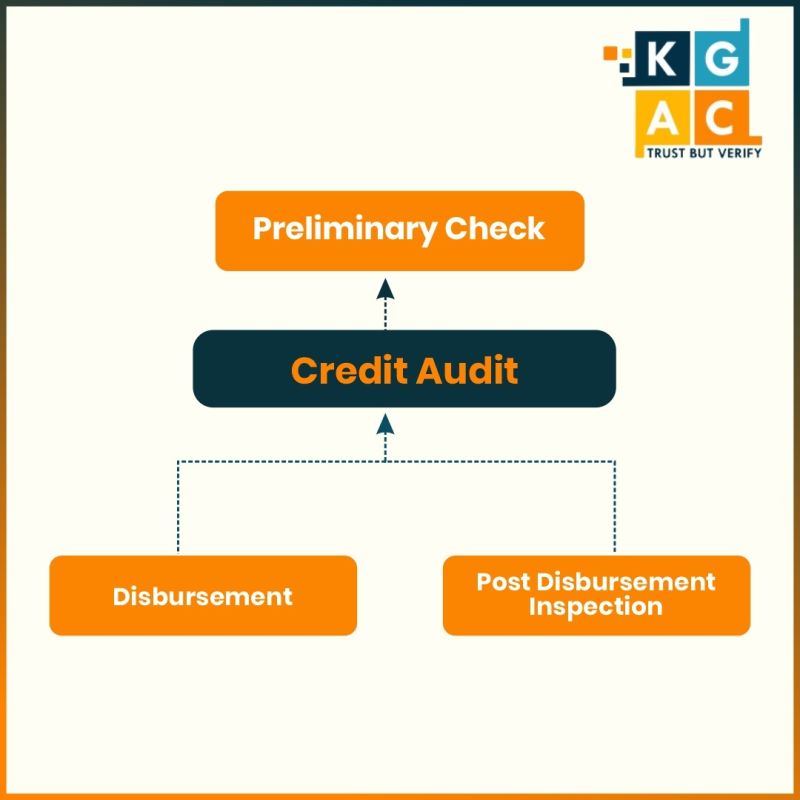

The principles of lending revolve mainly around the concepts of safety, profitability and liquidity of advance. The verification of Loan Accounts is divided into three parts, viz.𝗣𝗿𝗲𝗹𝗶𝗺𝗶𝗻𝗮𝗿𝘆 𝗖𝗵𝗲𝗰𝗸, 𝗗𝗶𝘀𝗯𝘂𝗿𝘀𝗲𝗺𝗲𝗻𝘁 𝗮𝗻𝗱 𝗣𝗼𝘀𝘁 𝗗𝗶𝘀𝗯𝘂𝗿𝘀𝗲𝗺𝗲𝗻𝘁 𝗜𝗻𝘀𝗽𝗲𝗰𝘁𝗶𝗼𝗻.

𝐏𝐫𝐞𝐥𝐢𝐦𝐢𝐧𝐚𝐫𝐲 𝐂𝐡𝐞𝐜𝐤:

The careful selection of a borrower stands as the paramount consideration. Numerous cases have occurred where individuals engage in fraud and forgery to deceive banks and access financing. Banks can prevent many of these instances by diligently adhering to the KYC principles in both word and deed.

An auditor should look at the following documents to check the bank’s preliminary process:

✅Loan Application in the prescribed application form.

✅KYC compliance.

✅ Assessment of project report, projected turnover, Projected balance sheet and P&L, and flow/funds flow statements.

✅ List of Sundry creditors and Sundry debtors during the current financial year and estimated balance sheet as of the end of the current financial year, etc.

✅Latest Audited Financial papers.

✅Board Resolution for availing credit facilities in case of Limited companies.

✅Caution advice and defaulter list of RBI/ECGC caution list/CIBIL.

𝐃𝐢𝐬𝐛𝐮𝐫𝐬𝐞𝐦𝐞𝐧𝐭:

An auditor must verify that disbursements occur only when all the terms and conditions outlined in the sanction letter have been met and an acceptance letter confirming the same has been obtained. The execution of the loan documents should align with the terms and conditions specified in the sanction letter. Payments for purchased goods or machinery should be made directly to the supplier through a demand draft based on the invoice. All original documents are securely stored in a fire-resistant safe.

𝐏𝐨𝐬𝐭 𝐃𝐢𝐬𝐛𝐮𝐫𝐬𝐞𝐦𝐞𝐧𝐭 𝐈𝐧𝐬𝐩𝐞𝐜𝐭𝐢𝐨𝐧:

✅The inspection shall ascertain the end use/creation of assets from bank finance.

✅The bank’s board of hypothecation/pledge shall be displayed where the stocks/machinery are placed.

✅The working capital limits sanctioned are usually valid for one year.

✅The documents obtained while releasing the limits shall be properly maintained, revival letters, acknowledgment of debts, etc., to be obtained periodically to keep the documents alive.

✅An asset created by bank finance shall be fully insured with a bank clause.

✅Verify the drawing power of the accounts is calculated properly and that a margin is maintained as per the sanction letter.

✅ Verify any adverse comments on the stock audit report or the audited balance sheet.