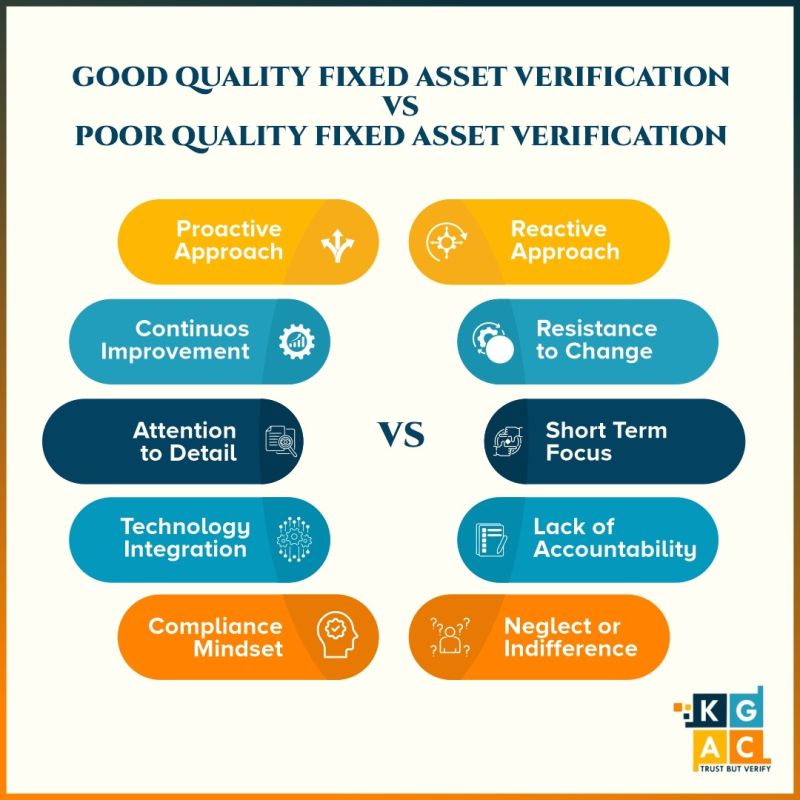

The mentality behind good quality fixed asset verification and poor quality fixed asset verification can significantly impact an organization’s overall financial health, operational efficiency, and compliance.

𝗚𝗼𝗼𝗱 𝗤𝘂𝗮𝗹𝗶𝘁𝘆 𝗙𝗶𝘅𝗲𝗱 𝗔𝘀𝘀𝗲𝘁 𝗩𝗲𝗿𝗶𝗳𝗶𝗰𝗮𝘁𝗶𝗼𝗻:

✅𝗣𝗿𝗼𝗮𝗰𝘁𝗶𝘃𝗲 𝗔𝗽𝗽𝗿𝗼𝗮𝗰𝗵:

The organization prioritizes proactive measures to guarantee precise and current fixed asset documentation. Engaging in proactive asset verification demonstrates a dedication to financial precision and regulation adherence.

✅𝗔𝘁𝘁𝗲𝗻𝘁𝗶𝗼𝗻 𝘁𝗼 𝗗𝗲𝘁𝗮𝗶𝗹:

Conducting a comprehensive and detailed verification is crucial in pinpointing discrepancies, averting financial misstatements, and guaranteeing the organization’s records.

✅𝗖𝗼𝗻𝘁𝗶𝗻𝘂𝗼𝘂𝘀 𝗜𝗺𝗽𝗿𝗼𝘃𝗲𝗺𝗲𝗻𝘁:

Consistently reviewing and upgrading verification procedures enhances efficiency, minimizes errors, and allows for adaptation to changes in the organization’s asset structure.

✅𝗧𝗲𝗰𝗵𝗻𝗼𝗹𝗼𝗴𝘆 𝗜𝗻𝘁𝗲𝗴𝗿𝗮𝘁𝗶𝗼𝗻:

The incorporation of technological tools aids in minimizing human error, enhancing efficiency, and offering real-time insights into the status of fixed assets.

✅𝗖𝗼𝗺𝗽𝗹𝗶𝗮𝗻𝗰𝗲 𝗠𝗶𝗻𝗱𝘀𝗲𝘁:

Dedication to upholding accounting standards, regulatory requirements, and internal policies is paramount. Maintaining compliance reduces legal risks, prevents penalties, and bolsters the organization’s financial integrity.

𝗣𝗼𝗼𝗿 𝗤𝘂𝗮𝗹𝗶𝘁𝘆 𝗙𝗶𝘅𝗲𝗱 𝗔𝘀𝘀𝗲𝘁 𝗩𝗲𝗿𝗶𝗳𝗶𝗰𝗮𝘁𝗶𝗼𝗻:

✅𝗡𝗲𝗴𝗹𝗲𝗰𝘁 𝗼𝗿 𝗜𝗻𝗱𝗶𝗳𝗳𝗲𝗿𝗲𝗻𝗰𝗲:

The importance of fixed asset verification needs to be addressed. Disregarding this process can result in inaccurate financial reporting, compliance challenges, and operational inefficiencies from outdated or incomplete asset records.

✅𝗦𝗵𝗼𝗿𝘁-𝗧𝗲𝗿𝗺 𝗙𝗼𝗰𝘂𝘀:

Disregarding the significance of precise fixed asset records may lead to costly errors and operational disruptions in the future.

✅𝗟𝗮𝗰𝗸 𝗼𝗳 𝗔𝗰𝗰𝗼𝘂𝗻𝘁𝗮𝗯𝗶𝗹𝗶𝘁𝘆:

Without clear accountability, there is an increased risk of asset misuse, misplacement, or theft, as employees may need to be more accountable for maintaining accurate records.

✅𝗥𝗲𝘀𝗶𝘀𝘁𝗮𝗻𝗰𝗲 𝘁𝗼 𝗖𝗵𝗮𝗻𝗴𝗲:

Reluctance to incorporate new technologies or enhance verification processes is evident. Failing to embrace technology can result in inefficiencies, a rise in errors, and an incapacity to align with the organization’s evolving needs.

✅𝗥𝗲𝗮𝗰𝘁𝗶𝘃𝗲 𝗔𝗽𝗽𝗿𝗼𝗮𝗰𝗵:

Dealing with verification issues solely when problems surface, instead of proactively preventing them, is counterproductive. Reactive approaches may lead to financial discrepancies, depreciation in asset value, and difficulties during audits.